Generative AI has become a sensation in the business realm. It makes headlines with prominent language models like OpenAI’s ChatGPT. Even top-level executives catch onto the excitement. AI claims a significant portion of IT budgets, projected to reach $154 billion globally this year. It’s a solid 27% jump from 2022. Whether businesses will use these resources wisely is the key question, though. IBM research found that the answer is yes — as long as organizations approach it with discipline. Today, let’s look into the intricacies of the ROI of AI and figure out how to calculate it.

What is the ROI of AI, and Why Does it Matter?

GenAI is on the brink of transforming the business landscape, with the estimated capacity to contribute $2.6 to $4.4 trillion each year to the global economy. It represents a substantial surge in the overall influence of tech.

Every corner of the business world is feeling the influence. Sectors like financial services, high-tech, and life sciences are set to gain big. The financial sector is likely to see a yearly boost of $200 billion to $340 billion with full implementation. There’s significant growth potential in retail, too. Estimates range from $400 to $660 billion annually.

AI ROI analyzes financial returns and parallels them to the expenditures incurred during AI initiatives. In its most basic form, ROI is a financial ratio that compares an investment’s profit or expense to its cost. When investing in AI, the profits should far exceed the costs.

Gartner offers some advice: if you want to evaluate the value of new investments in genAI, start by creating business cases. Simulate potential costs and values, and aim for a combination of:

- Quick results

- Differentiation of use cases

- Transformational initiatives

When it comes to GenAI quick wins, the emphasis is on performance. Microsoft 365 Copilot and Google Workspace assistants can come in handy. These tools are easy to test and apply, and are typically task-specific. What’s more, you can start seeing value in less than 12 months.

When we look at the bigger picture, companies should focus on metrics that measure not only financial returns, but also strategic outcomes. It includes improving the UX and broadening access to opportunities with minimal skill requirements. This tool will help companies to reliably evaluate the effects of AI.

In the business environment today, many companies reap the rewards of their AI endeavors with positive returns on investment (ROI). The survey highlights these areas as key areas demonstrating significant progress:

- client support and experience (74 percent);

- IT operations and infrastructure (69 percent);

- planning and decision-making (66 percent).

However, some companies are still trying to unlock the perks of AI and get a return on investment.

Want to make the most of an AI initiative? It depends on the right experience and knowledge. The ROI on these projects can vary greatly. First of all, it depends on how mature the firm is. Leaders have demonstrated an average ROI of 4.3% on their projects. By comparison, it’s a jump from the modest 0.2% reported by newcomers. When it comes to payback periods, leaders typically see it in 1.2 years. Beginners look at around 1.6 years.

How to Measure ROI of Generative AI Investments

When you put in time, all your effort and finances, the big question always boils down to ROI — is it worth it? When it comes to AI, the standard rules of ROI don’t always hold up. The usual method of ROI artificial intelligence calculation is clear-cut. You invest in some tech, and if it makes more money than it costs, you’ve got a positive ROI.

ROI estimations focus on gains vs costs. Those indicators for gains are handy, but do they really paint the whole picture? Not even close. So, what else is it essential to consider?

Client Satisfaction (CSAT) and Net Promoter Score (NPS)

It’s crucial to grasp how AI and automation shape customer satisfaction. After all, a top-notch CX not only delights clientele but also boosts ROI, as happy clients tend to come back. Metrics like CSAT and NPS give us concrete measures of user happiness and loyalty. It paints a clear picture of how well AI is making these experiences positive.

Cost efficiencies and revenue boost

One key advantage of AI is its ability to yield cost savings. AI has the potential to cut labor expenses and amp up operational efficiency. Businesses can conduct a comparative analysis of expenses before and after AI introduction to assess cost savings. Consider factors like:

- Decreased workforce needs.

- Lower error rates.

- Improved resource allocation.

Nevertheless, AI doesn’t just cut costs. It can also elevate CX and fuel revenue growth. AI-powered analytics and predictive modeling help pinpoint fresh revenue avenues and target the right customers. When we analyze the upsurge in revenue from AI initiatives, we need to keep an eye on tangible outcomes like scaled-up sales and the success of client acquisition. Moreover, we have to consider the long-term value each client brings.

Boost in efficiency

Efficacy gains represent a vital metric in the evaluation of AI ROI data. AI tech automates manual tasks and facilitates quicker decision-making. Furthermore, they minimize human error and amp up productivity. That way, firms can accomplish more with fewer resources. But how do we quantify efficiency gains? Assess metrics like process cycle time and task completion time. Compare resource use rates before and after AI introduction to see whether it’s viable.

Tips for Maximizing ROI in Generative AI

Want to guarantee the optimal return on investment from gen AI solutions? Adopt a comprehensive approach that goes beyond traditional financial calculations. Let’s look at these tips to help you get the most out of your AI ROI:

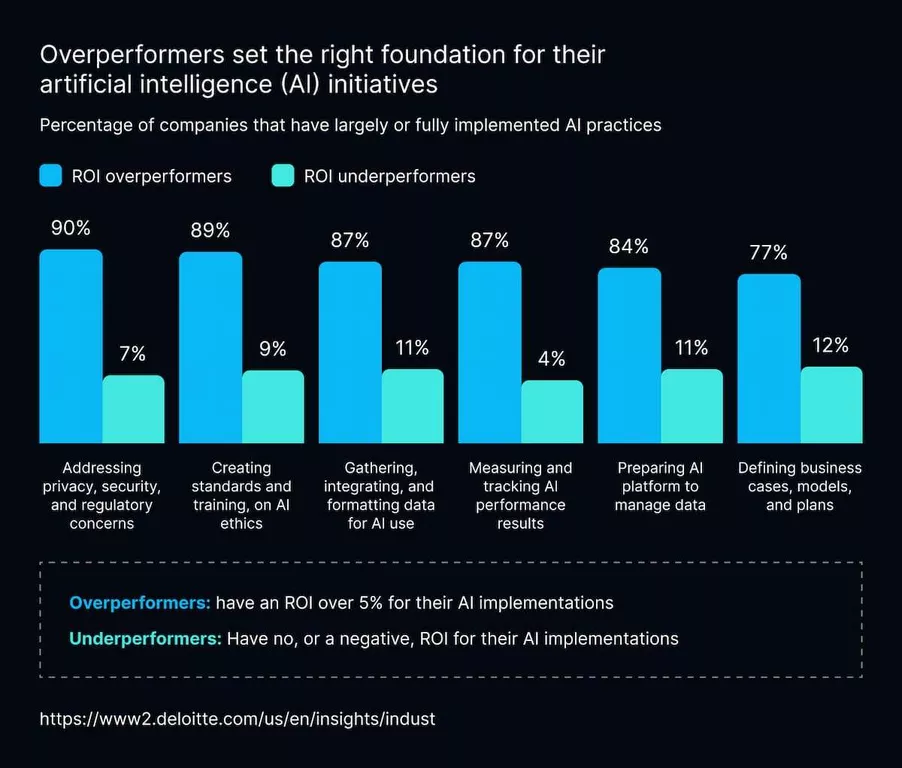

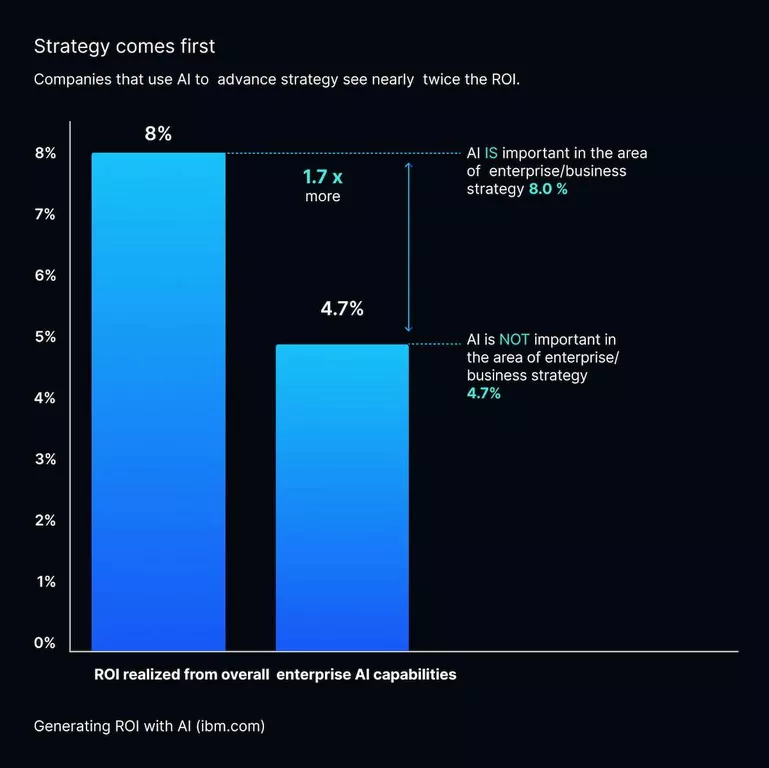

- Examine where strategic investments go for core and non-core operations across different business divisions. It helps you to identify strategic plans to harness AI. A well-designed AI strategy can accelerate transformation efforts and increase the return on investment for the initiatives. IBM research highlights, organizations that view AI as necessary to their business strategy are 1.8 times more likely to be effective with their AI initiatives and achieve twice the ROI.

- Examine long-term returns for GenAI. The spotlight frequently falls on short-term gains. Yet, managers should broaden their perspective to include the long-term value of genAI. Forecast consistent income growth and operational productivity over an extended period. It offers a holistic picture of the genuine impact of AI investments.

- Keep a constant eye on the performance of AI projects and essential metrics. It helps firms catch any deviations or bottlenecks early to prompt corrective actions.

- Create a feedback loop with end users and stakeholders to collect thoughts and ideas for improvement. It becomes an invaluable tool for identifying optimization opportunities and shaping future initiatives.

Millions of businesses across various fields have already boosted their AI and machine learning ROI – and you should, too. MetaDialog can help you get the most out of your investments with tailored LLM models or AI support platforms.

Final Words

It’s crucial to estimate the profitability for AI investments to grasp the value they add to businesses. If you hone in on vital metrics like cost savings or revenue growth, you get to estimate the long-term effects of AI initiatives and make data-backed decisions.

Adhere to best strategies of AI ROI estimation to arrive at well-thought-out decisions about potential AI investments. It’ll help you foster continuous advancement of your initiatives. In a world progressively dominated by AI, a well-trusted tech partner at your disposal is a must. Choose MetaDialog if you want to bring your AI game to the next level and get the most out of it.