The rapid development of artificial intelligence (AI) technology has transformed business processes across many industries. In the world of finance, the role of algorithm-based solutions is expected to increase. Financial organizations recognize the significance of implementing AI tools for improving the efficiency of internal processes, enhancing customer experience (CX), and introducing top-grade security measures. However, it won’t suffice to exploit current trends to maintain an edge over competitors. The future of AI in banking is being created now, so learning how to deploy such solutions is crucial for institutions that want to strengthen their market positions.

What is the Future of AI in Banking?

The early adoption of AI is the only way for institutions to achieve sustainability in the long run. Meeting customer demand necessitates providing personalized services while ensuring data privacy and adhering to current laws.

With 68% of organizations in the industry investing in AI technology, the usage of artificial intelligence in financial services is predicted to become even more widespread in the coming years. According to some estimates, AI bots will handle 25% of customer interactions. However, integrating such solutions with legacy systems without experience may be arduous. MetaDialog builds and deploys custom AI tools designed to automate 87% of conversations and reduce workload.

Pre-trained large language models (LLMs) change UX in the banking sphere in several ways:

- Accurate data analysis: Understanding customer needs is crucial to providing top-notch digital banking services and solving queries promptly. Besides, it is instrumental in offering personalized financial advice. Targeted recommendations help inexperienced investors to protect their capital and maximize gains. Handling large amounts of data facilitates uncovering suspicious behavior patterns and preventing fraud. It expedites onboarding, streamlines the verification processes, and makes it easier for clients to choose relevant products.

- Task automation: The usage of generative AI in banking facilitates automating a variety of tasks, including password reset and balance inquiries, which allows CS teams to fully dedicate themselves to solving complex issues. MetaDialog’s AI-based systems reduce the average resolution time to 20 seconds, enabling customers to get pro-level support 24/7.

- Enhanced banking experience: Due to the integration with native financial apps, AI tools help clients finalize transactions, access account information, and receive automated notifications.

As LLMs are capable of learning based on feedback, they provide more relevant replies and answer complex queries. They can answer voice calls in multiple languages, enabling banks to expand outreach.

Top 5 Ways of How AI Will Transform Banking

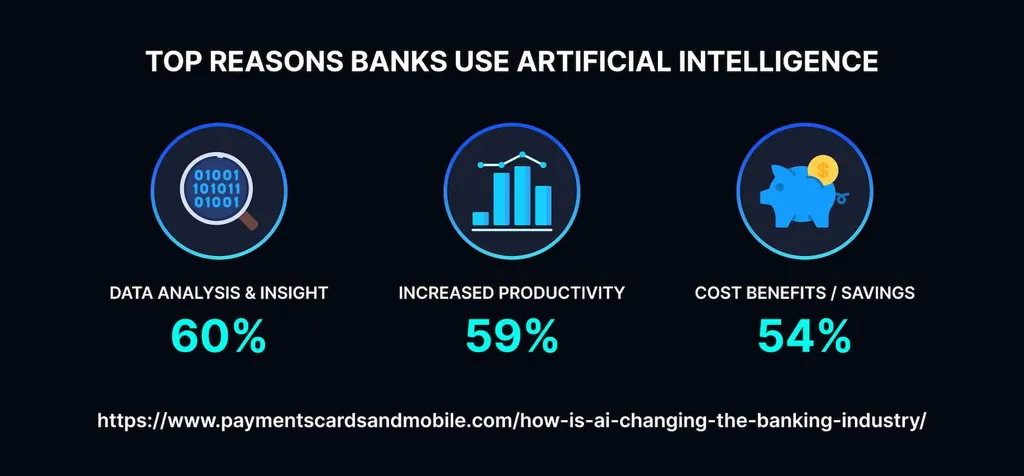

The usage of predictive intelligence in the finance industry is anticipated to improve customer satisfaction by 20%. While the integration of algorithm-driven bots enables banks to achieve better productivity, there are other reasons to implement such tools to achieve strategic goals. We have outlined the major potential changes caused by AI that impact the banking sector:

- Financial operations: Bots let users quickly transfer funds or pay sellers, making the usage of financial apps more convenient.

- Account management: AI models could be trained to perform many tasks related to the usage of a bank account. They set up automatic payments, edit personal information, and monitor cash flows. Using them, clients access data about transaction history and account balances to make the necessary improvements.

- Financial advice: Inexperienced users may need assistance to make reasonable investment decisions. Trained bots let them devise result-yielding strategies, improve budgeting skills, and set achievable objectives.

- Loan applications and other tasks: AI bots guide clients through all the steps of application procedures and help them submit insurance claims within a specified timeframe.

- Robust security: Utilizing AI, banks monitor transactions and spot suspicious activities to prevent fraud or unauthorized access.

Recognizing the potential of AI, MetaDialog deepens its cooperation with the financial sector. The company develops AI-powered tools designed to provide real-time updates on market dynamics and exploit potentially lucrative opportunities. It builds systems with advanced predictive capabilities that enable investors to make fact-based decisions.

MetaDialog strictly adheres to current regulations, so its advanced LLMs handle sensitive data securely. Besides, they accurately assess risks and offer pathways to their mitigation.

How Will AI Help Banks Achieve Sustainability

Another aspect of the future of AI in banking is related to the usage of green technologies. Nowadays, customers care about a company’s reputation and often decide to switch to another financial service provider if a bank does not follow environmentally friendly practices.

In Europe, banks already disclose information about whether specific transactions are green. While tasks such as analyzing financial operations and categorizing deals as green are now done manually, this situation will change as banks start deploying machine-learning tools.

For instance, when a business takes loans for installing solar and wind power stations, such operations are considered climate-friendly, making firms eligible for some financial incentives. In the future, AI tools will automatically classify transactions, reducing financial advisors’ workload.

Even though humans will still have to approve the financial decisions, technological innovations will expedite green technology adoption and allow banks to maintain sustainability.

Leveraging AI to Fight Financial Crime

The future of AI in finance remains bright, as many banks now see the potential benefits of deploying such tools to track down fraudsters and other malicious actors who steal client data and access bank accounts without authorization. Advanced LLMs can be trained to efficiently counter criminal actions. They perform the following tasks:

- Analyze and categorize transactions;

- Create lists of suspicious activities;

- Analyze cash flows.

Using such screening tools, banks will reduce the workflow of their anti-crime units and process data to detect threats efficiently. While such AI systems already exist, their functionality remains quite basic. By enhancing their ability to detect money laundering cases and recognize tax evasion practices, complex LLMs will excel in data analysis, which will make them an integral part of security systems.

AI services will enable banks to build trust by safeguarding the information about client transactions and ensuring that nobody will access their data. Due to the high flexibility of AI models and extensive customization options, banks will combat crime more effectively.

Conclusion

Integrating AI tools with traditional instruments is an arduous process. Many organizations outsource this task to trusted service providers to reduce expenses and achieve better results. MetaDialog specializes in building secure AI-powered systems designed to prevent data leakage. The company has a team of experienced developers with extensive backgrounds in building AI tools that support intelligent document processing, generating relevant financial advice, and making informed investment predictions.

The future of AI in banking depends on the current scale of technology adoption. Banks that recognize the potential of algorithm-powered solutions will get an edge over competitors and establish a strong presence in the industry. Get in touch with our experts now and discover how to provide top-notch banking services using AI.