Recent surveys showed that more than 100 million Americans have already granted third-party access to their personal financial data via open banking, and this number will rise in the following years. In this blog article, we will explain how AI is merged with open banking and why it is advantageous for ventures to utilize such solutions. Because this synergy totally changes how companies manage their money, access critical data, and mitigate risks. Understanding and using open banking AI is necessary for banks, fintech organizations, and various consulting services to stay competitive in quickly changing circumstances.

AI in Open Banking in Simple Terms

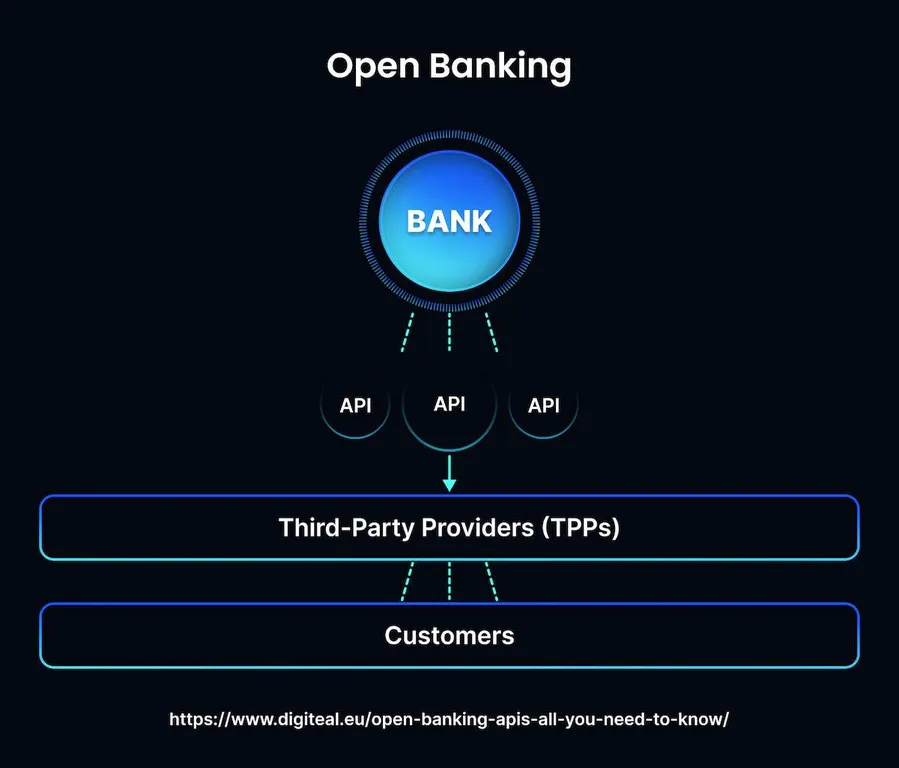

Open banking allows companies to better understand their client’s financial needs and offer highly personalized and tailored financial services thanks to sharing critical information. Although open banking adoption is still underway, 53% of US banks already see significant revenue boost thanks to the improved analytics.

AI in open banking relies on machine learning, natural language processing, and other AI techniques to interpret large datasets, provide actionable advice, and automate working processes. This helps turn raw information into actionable intelligence for business owners.

With algorithmic insights, banks can automate credit scoring, streamline regulatory compliance, and offer instant financial advice, all while diminishing operational expenditures. Furthermore, AI tools enable more precious monitoring of transactions and highlighting anomalies to guarantee customer data is secure.

How Open Banking AI Can Benefit Your Organization

Imagine having real-time insights into your business’s financial health, accurately predicting future cash flow, and launching new products that your clients really need. AI-powered tools make this possible without extra effort. For example, such tools could alert you to a suspicious transaction, prevent potential losses, or automatically generate financial reports, freeing up your team for more strategic work.

Let’s dive deeper into how open banking AI can benefit your business:

- Smart money flow management: AI algorithms analyze transaction streams, anticipate future revenue rates, flag possible bottlenecks, and suggest optimal strategies for managing capital. This provides businesses with a virtual CFO, proactively alerting them to potential cash shortfalls or opportunities for investment.

- Personalized financial services: By analyzing vast amounts of data, like transaction history, spending categories, and market tendencies, generative AI in banking helps financial institutions and fintech ventures to offer customized loan options, insurance premiums, and investment plans.

- Enhanced fraud identification and safety: AI algorithms spot suspicious transaction patterns in real time, highlighting potentially fraudulent activities before they cause significant damage, protecting businesses from financial losses, and building client trust.

- Minimized operational expenses: Automating manual processes, streamlining workflows, and optimizing resource allocation can significantly diminish operational expenditures.

- Promoting innovation and collaboration: Open banking AI drives innovation in the financial domain, fostering collaboration between traditional banks, fintech companies, and third-party developers.

Moreover, by leveraging AI-powered analytics, financial ventures can more accurately estimate creditworthiness and suggest individualized financial products to previously underserved groups of clients.

Main Stages of the Implementation

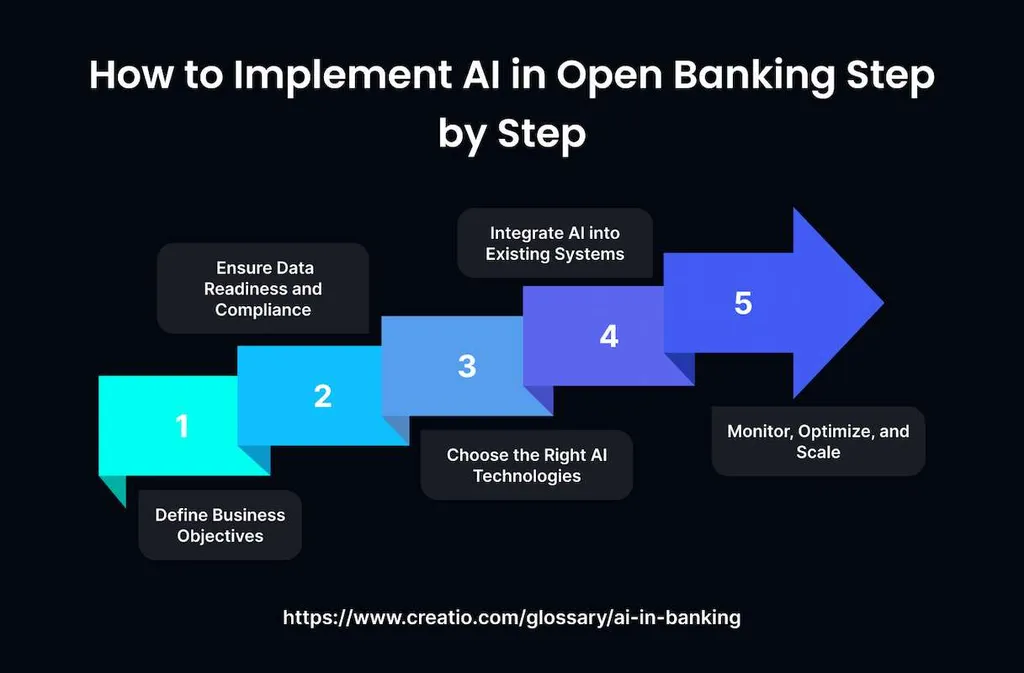

Successfully integrating open banking AI requires careful planning. As a business owner, you should start by identifying your specific needs and goals. For example, are you struggling with funds flow prediction or need to improve your fraud detection capabilities? Perhaps you’re looking for more personalized financial product recommendations. Clearly defining your objectives will guide your subsequent steps.

Then, you should research and select appropriate financial institutions and fintech partners that offer open banking AI solutions tailored to your requirements. Consider factors like the overall partner’s reputation, the features of their solutions, their integration capabilities, and their pricing models.

A phased implementation approach, starting with trial projects and gradually scaling up, is recommended. Begin with a small-scale implementation in a specific department or area of your business to test the solution and identify any potential issues before rolling it out company-wide. For example, you might start by implementing AI-powered cash flow forecasting for one product line before expanding it to your entire portfolio.

Constant monitoring and evaluation are mandatory to ensure the implemented solutions deliver the desired results. Track key metrics, such as cash flow accuracy improvements, fraud loss reductions, or time saved through automation. Regularly review your progress and make adjustments as needed.

Common Challenges You Can Face

The ethical use of AI is a popular trend among most businesses today. Despite the benefits, integrating AI into open banking comes with its own set of challenges:

- Data privacy: With more data being shared, ensuring robust data protection measures is crucial. Financial institutions must adhere to strict regulatory standards such as GDPR.

- Integration complexity: Connecting AI tools with existing legacy systems can be arduous and require significant investment.

- Bias and accuracy: AI models can sometimes inherit biases from the datasets on which they are trained. Thoroughly filter and prepare datasets to minimize such risks. Moreover, ongoing monitoring and updates are necessary to ensure fairness in decision-making.

While AI offers improved security, maintaining a customer centric banking approach through transparent practices and robust security protocols is essential. Openly tell about how you collect and store data, and don’t ignore the latest advancements in security protocols.

The Future of AI in Open Banking

The future of open banking AI lies in its ability to adapt and evolve. As AI in finance continues to advance, we can expect even more sophisticated solutions that drive deeper personalization, heightened security, and seamless integration across multiple platforms. Innovations such as blockchain integration, enhanced data analytics, and predictive modeling will further bolster the capabilities of open banking, making financial services more accessible and secure.

Understanding and leveraging AI is a strategic imperative for business owners looking to thrive in the digital age. But navigating this complex market can be challenging. This is where a specialized service provider like MetaDialog can make all the difference. We are at the forefront of AI popularization, offering cutting-edge AI solutions to empower businesses like yours. We understand that every firm is unique, so we take a personalized approach.

At MetaDialog, we go beyond simply providing technology. We offer a comprehensive suite of services, from initial consultation and needs assessment to ongoing support and optimization. Our team will work closely with you to identify the areas where AI can impact your business, whether automating workflows, enhancing your fraud detection capabilities, or gaining deeper insights into your customer behavior. We’ll help you develop a tailored roadmap for integrating open banking AI into your existing systems, ensuring a smooth and efficient transition.