The usage of artificial intelligence (AI) technology in the financial industry helps organizations optimize processes, automate workflows, and reduce expenses. Large Language Models (LLMs) are designed to process massive volumes of data, enabling enterprises to enhance the quality of customer support (CS) services and detect fraudulent activities. Top executives were quick to recognize the potential of AI in retail banking and implement algorithm-based solutions built to expedite routines. In this guide, we will explore how ventures can stay competitive and remain ahead of the curve by integrating AI-driven tools.

How to Use AI in Retail Banking

Building a spotless reputation is essential to achieve sustainable growth in the finance industry. It involves implementing safety mechanisms to protect client data and integrating efficient task automation solutions. Generative AI systems stand out for their problem-solving capabilities, helping banks serve customers better.

The usage of artificial intelligence in retail banking enables organizations to leverage the power of machine learning (ML) to process financial records and recognize suspicious behaviors. Below, we have outlined how AI tools let businesses embrace a customer-centric approach and make informed decisions.

AI-Powered Fraud Prevention

Eliminating the threat of cybercrimes requires banks to take efficient steps to minimize the occurrence of fraud. Powerful ML algorithms facilitate analyzing transactions and information about user devices to identify issues that may compromise the safety of clients’ funds. The deployment of genAI in banking facilitates biometric verification, adding an extra protection layer. The ability of LLMs to learn and improve their performance allows them to deal with emerging threats and fix security issues without the help of human agents.

AI-Based Risk Mitigation

Retail bank digital transformation also involves implementing solutions that ensure the stability of an institution. Efficient management practices facilitate addressing threats proactively, which saves small organizations a lot of resources. AI empowers businesses to increase efficiency when identifying risks and implementing safety mechanisms.

Firms train LLMs using historical data, enabling algorithms to recognize patterns invisible to a human’s eye. It helps banks to succeed in the changing environment and adapt their systems to counter threats. AI models also analyze spending habits and income histories to assess a person’s creditworthiness. They demonstrate high efficiency in considering market risks. Using data collected by AI tools, organizations make better investment decisions.

Advanced Predictive Analytics

Making accurate forecasts requires using AI-driven tools trained to analyze large datasets, predict price changes, and foresee potential developments. Retail banks that deploy LLMs can extract valuable insights from in-depth trend analysis. AI models unveil correlations between events, analyze current indicators, and examine behavior patterns. AI-based predictive analytics in retail banking empower financial organizations to make fact-based decisions, adopt efficient investment strategies, improve offerings, and optimize resource usage.

MetaDialog builds powerful LLMs that analyze a variety of factors and indicators. The usage of AI in finance facilitates making accurate predictions based on current events, consumer sentiment, and possible market developments. Algorithm-based models process client data and predict their needs and spending patterns, allowing organizations to personalize offerings.

Increased Engagement Rate

Personalization is the key to improving customer experience (CX) and getting an edge over competitors. The usage of AI in retail banking facilitates the creation of custom offerings. Companies analyze client preferences to cater to their needs. AI models consider the following:

- Transaction history;

- Browsing habits;

- Interactions with a company.

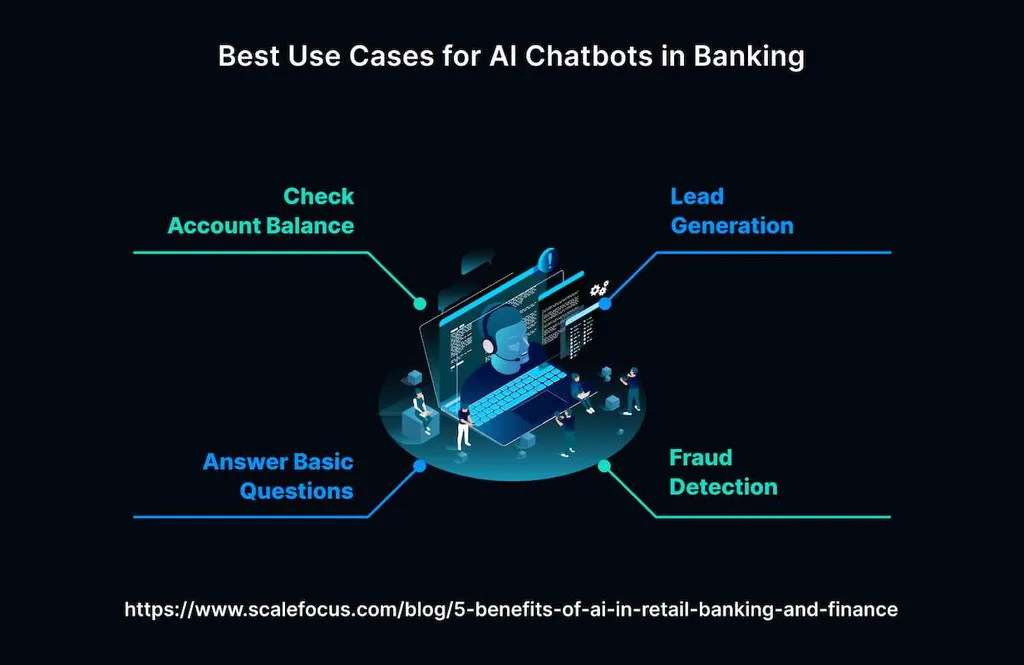

The collected detailed information enables organizations to offer personalized advice and increase the efficiency of their marketing efforts. Higher personalization enables banks to boost satisfaction, strengthen client relationships, and foster loyalty and trust. The deployment of AI-driven chatbots helps companies to engage clients in conversations and provide personalized customer experience. Such solutions generate context-relevant responses 24/7.

MetaDialog builds powerful chatbots that enable businesses to reduce the average response time to 20 seconds and increase the CS team’s productivity by 5 times. Using such solutions allows banks to improve the quality of their services and provide personalized advice.

AI in Process Optimization

Companies seek to streamline convoluted processes to reduce resource usage and solve problems more efficiently. By automating retail operations, banks spend less time processing documents and answering client requests. The usage of generative AI in financial services allows banks to make their procedures less complex and achieve higher automation. The deployment of such tools is necessary to detect risks and maintain compliance.

When training AI models, developers can eliminate biases to ensure credit scores are calculated accurately. It makes it easier for people from underprivileged communities to borrow money. AI tools analyze real-time data about spending and income, consider the impact of international events, and detect signs of dissatisfaction. It allows them to serve customers better and predict future trends.

The implementation of smart banking systems empowers organizations to provide top-quality financial services and adapt to the changes in the industry. Banks deploy advanced AI systems utilizing OCR and NLP technologies to handle documents with higher efficiency, extract data, and fill mistake-free reports. It lets them speed up document processing and eliminate bottlenecks hindering their growth. AI tools ensure data consistency across all banking services used by an organization.

Robo-Advisory Solutions

As it is essential to handle an increased demand for financial advisory services, banks utilize AI to make their offerings more accessible. By deploying a robo advisor, organizations and wealth managers can provide professional investment recommendations to clients.

The usage of ML techniques helps virtual advisors assess risk profiles and analyze investment goals to adopt the best strategies for managing risks and diversifying a portfolio.

Robo advisors analyze a person’s finances to offer tailored advice regarding their portfolios. They also consider current market conditions and recommend adjusting asset allocation when the situation becomes unfavorable.

AI-Powered Credit Scoring

Algorithm-driven systems enable banks to access borrower risks with increased accuracy and adjust their credit scoring policies. It allows them to embrace a fair approach and avoid discriminating against low-income clients with less stellar credit history. AI tools remain impartial when analyzing career development opportunities, spending patterns, and income. It makes their assessments less discriminatory than traditional credit scores.

Major companies from the FinTech sector utilize a variety of data sources. It empowers them to develop client-centric financial services and improve their accessibility. AI algorithms process large volumes of information about global events, consumer sentiments, and the current state of the economy.

Improved Regulatory Compliance

The deployment of AI in retail banking also allows organizations to adhere to current regulations and avoid hefty fines. As the industry follows strict rules, tracking the changes in legislation is necessary to ensure the integrity of deployed systems and safeguard customer data. Institutions use AI models to remain compliant. They monitor financial operations and flag risky transactions. Their usage allows banks to win clients’ trust and adopt a transparent approach.

AI systems excel in monitoring transactions and interactions with consumers. Besides, they facilitate the creation of detailed compliance reports and finalizing auditing processes. LLM-based solutions can be trained to detect non-compliance issues and suggest the necessary steps to remove possible threats.

Why Deploy AI Models in Retail Banking

Banks strive to achieve higher accountability and transparency to win investors’ trust and outpace competitors. Recognizing the necessity to ensure equal access to their services, financial organizations strive to engage clients from different backgrounds. Institutions deploy AI to streamline onboarding processes, follow anti-money laundering regulations, and implement KYC policies.

The usage of AI in retail banking facilitates enhancing the accessibility of such services and minimizing risks associated with financial operations. However, implementing such solutions is daunting without a strong technical background. MetaDialog builds custom LLMs for organizations of all sizes to help them optimize procedures, reduce resource usage, and enhance security. Get in touch with our team to discover how to increase the efficiency of banking operations using AI.